**Is Turner Network Television Stock a Good Investment?**

Turner Network Television Stock represents a piece of a significant player in the entertainment industry and understanding its value is crucial for investors interested in media and entertainment. At monstertelevision.com, we delve into the details of media stocks and the entertainment business, providing viewers with information to navigate their financial decisions and explore the world of monster-themed television. Let’s explore the entertainment industry stocks.

1. What Is Turner Network Television (TNT)?

Turner Network Television (TNT) is a cable television network that features a mix of drama series, sports events, and blockbuster movies. TNT focuses on entertainment and provides broad programming appeal, making it a staple in many households. According to a report by Nielsen in 2023, TNT reached over 86 million households in the U.S., highlighting its popularity and reach.

1.1 What Kind of Shows Does TNT Have?

TNT boasts a diverse array of content, ensuring there’s something for everyone:

- Drama Series: TNT is known for its gripping drama series like “The Alienist,” offering viewers complex storylines and compelling characters.

- Sports Events: TNT broadcasts major sports events such as NBA games, attracting a large and engaged audience.

- Blockbuster Movies: TNT airs a wide selection of blockbuster movies, providing entertainment for movie lovers.

1.2 How Did TNT Get Started?

TNT’s journey began on October 3, 1988, founded by media mogul Ted Turner. Turner aimed to create a network that would offer a wide range of programming, from classic films to original series, catering to a broad audience. Turner’s vision quickly turned TNT into a household name. According to a 1995 article in the Los Angeles Times, TNT reached 50 million subscribers within its first six years, making it one of the fastest-growing cable networks at the time.

2. Who Owns Turner Network Television (TNT)?

Turner Network Television (TNT) is currently owned by Warner Bros. Discovery. Warner Bros. Discovery was formed in April 2022, following the merger of WarnerMedia (formerly owned by AT&T) and Discovery, Inc. This merger brought together a vast portfolio of media and entertainment assets under one roof, including TNT, TBS, CNN, HBO, Discovery Channel, and many more.

2.1 How Did Warner Bros. Discovery Acquire TNT?

The acquisition of TNT by Warner Bros. Discovery was part of a larger corporate restructuring in the media industry.

- AT&T’s Acquisition of Time Warner: In 2018, AT&T acquired Time Warner, which included TNT, for $85.4 billion. This move was intended to integrate content creation with distribution.

- Formation of Warner Bros. Discovery: In 2021, AT&T announced its plan to spin off WarnerMedia and merge it with Discovery, Inc. The merger was completed in April 2022, forming Warner Bros. Discovery.

- Integration of Assets: As a result of the merger, TNT became part of Warner Bros. Discovery’s extensive portfolio of media assets.

2.2 What Are the Implications of Warner Bros. Discovery Owning TNT?

Warner Bros. Discovery’s ownership of TNT has several significant implications:

- Content Synergies: Warner Bros. Discovery can leverage its vast library of content to enhance TNT’s programming.

- Cost Efficiencies: The merger allows for cost efficiencies through shared resources and streamlined operations.

- Strategic Realignment: Warner Bros. Discovery can strategically align TNT with its other networks to optimize viewership and revenue.

3. What is Turner Network Television Stock?

There is no specific “Turner Network Television stock”. TNT is a cable television network owned by Warner Bros. Discovery, which trades under the stock ticker symbol WBD. Investors interested in TNT’s financial performance can purchase shares of Warner Bros. Discovery (WBD) on the stock market. Purchasing WBD stock means investing in the parent company that owns TNT, along with many other media and entertainment assets.

3.1 Why Can’t I Directly Buy Turner Network Television Stock?

You can’t directly buy Turner Network Television stock because TNT is not a standalone, publicly traded company. It’s a cable television network owned and operated by Warner Bros. Discovery.

3.2 What Does Buying Warner Bros. Discovery (WBD) Stock Mean for TNT?

Purchasing Warner Bros. Discovery (WBD) stock means investing in the parent company that owns TNT, along with many other media and entertainment assets. This investment reflects the overall financial health and strategic decisions of Warner Bros. Discovery, which includes the performance and potential of TNT.

4. How to Evaluate Warner Bros. Discovery (WBD) Stock

Evaluating Warner Bros. Discovery (WBD) stock involves analyzing various financial and market factors. This includes understanding the company’s financial statements, market position, and growth prospects.

4.1 What Financial Metrics Should I Consider?

When evaluating WBD stock, consider these key financial metrics:

- Revenue: Look at WBD’s total revenue and its growth rate. Revenue indicates the company’s ability to generate sales from its various segments, including TNT.

- Net Income: Net income shows the company’s profitability after all expenses and taxes. A positive and growing net income is a good sign.

- Earnings Per Share (EPS): EPS measures the company’s profitability on a per-share basis. It’s a key metric for investors as it indicates how much profit the company is generating for each share of stock.

- Debt-to-Equity Ratio: This ratio indicates the proportion of debt and equity the company uses to finance its assets. A high ratio can indicate financial risk.

- Cash Flow: Analyze WBD’s cash flow from operations to ensure the company has enough cash to cover its obligations and invest in growth opportunities.

4.2 How Does TNT’s Performance Affect WBD Stock?

TNT’s performance directly impacts Warner Bros. Discovery’s overall financial health.

- Revenue Contribution: TNT generates revenue through advertising, subscriber fees, and content licensing. Higher viewership and successful programming can lead to increased revenue for WBD.

- Profitability: TNT’s profitability contributes to WBD’s bottom line. Efficient management and cost control at TNT can improve WBD’s overall profitability.

- Strategic Importance: TNT’s strategic importance within WBD’s portfolio can influence investor perception. A strong and well-positioned TNT can enhance WBD’s attractiveness to investors.

5. What are the Pros and Cons of Investing in Warner Bros. Discovery (WBD) Stock?

Investing in Warner Bros. Discovery (WBD) stock has potential benefits and risks. Investors should weigh these factors before making a decision.

5.1 What are the Advantages of Investing in WBD Stock?

Investing in WBD stock offers several advantages:

- Diversified Portfolio: WBD owns a wide range of media assets, reducing risk compared to investing in a single network.

- Strong Content Library: WBD has an extensive library of content, including popular TV shows and movies.

- Global Reach: WBD operates globally, providing exposure to international markets.

- Cost Synergies: The merger of WarnerMedia and Discovery allows for cost efficiencies and streamlined operations.

5.2 What are the Disadvantages of Investing in WBD Stock?

Investing in WBD stock also involves potential disadvantages:

- High Debt Load: The merger resulted in a significant debt load, which could constrain WBD’s financial flexibility.

- Integration Challenges: Integrating the operations of WarnerMedia and Discovery may present challenges.

- Market Competition: The media industry is highly competitive, with new streaming services and content providers emerging regularly.

- Cord-Cutting Trends: The increasing trend of cord-cutting could negatively impact WBD’s cable networks, including TNT.

6. How Does Cord-Cutting Affect Turner Network Television Stock?

Cord-cutting, the trend of viewers canceling their traditional cable subscriptions in favor of streaming services, poses a significant challenge to traditional cable networks like TNT and impacts the perceived value of Warner Bros. Discovery stock.

6.1 How is TNT Adapting to Cord-Cutting?

TNT is employing several strategies to adapt to the changing media landscape:

- Streaming Services: Offering content through streaming platforms like HBO Max (now Max) to reach viewers who have cut the cord.

- Original Content: Investing in original programming to attract and retain viewers.

- Live Sports: Continuing to broadcast live sports events, which remain a draw for many viewers.

- Digital Distribution: Expanding digital distribution channels to reach younger audiences.

6.2 How Does TNT’s Performance in Streaming Affect WBD Stock?

TNT’s performance in the streaming market can influence investor sentiment towards WBD stock.

- Subscriber Growth: Increased subscribers on streaming platforms contribute to WBD’s revenue and growth prospects.

- Content Monetization: Successful monetization of content through streaming can enhance WBD’s profitability.

- Competitive Positioning: A strong streaming presence can improve WBD’s competitive positioning in the media industry.

7. What Are Some Alternative Investments to Turner Network Television Stock?

Investors interested in the media and entertainment industry can consider alternative investments to Warner Bros. Discovery (WBD) stock.

7.1 What Are Some Other Media Stocks to Consider?

Here are some other media stocks to consider:

- The Walt Disney Company (DIS): Disney owns theme parks, movie studios, and streaming services.

- Netflix (NFLX): Netflix is the leading streaming service with a global subscriber base.

- Comcast Corporation (CMCSA): Comcast owns NBCUniversal, a major media and entertainment company.

- Paramount Global (PARA): Paramount Global owns CBS, Paramount Pictures, and streaming services.

7.2 How Do These Stocks Compare to WBD?

Each of these stocks has its own strengths and weaknesses.

- The Walt Disney Company (DIS): Disney has a diversified portfolio, but its stock has been affected by challenges in its traditional media business.

- Netflix (NFLX): Netflix is a pure-play streaming company, but it faces increasing competition.

- Comcast Corporation (CMCSA): Comcast has a strong cable business, but its stock has been affected by cord-cutting trends.

- Paramount Global (PARA): Paramount Global is undergoing a strategic transformation, but its stock is considered risky.

8. What are the Key Factors Influencing the Value of Media Stocks Like WBD?

Several key factors influence the value of media stocks like Warner Bros. Discovery (WBD). Understanding these factors can help investors make informed decisions.

8.1 How Do Changes in Media Consumption Patterns Affect WBD Stock?

Changes in media consumption patterns significantly impact WBD stock.

- Shift to Streaming: The shift from traditional cable to streaming affects the revenue and profitability of WBD’s cable networks.

- Content Demand: The demand for high-quality content influences WBD’s ability to attract and retain viewers.

- Advertising Revenue: Changes in advertising spending can impact WBD’s revenue from its broadcast and cable networks.

8.2 How Do Economic Conditions Influence WBD Stock?

Economic conditions can also influence WBD stock.

- Consumer Spending: During economic downturns, consumers may reduce their spending on entertainment, affecting WBD’s revenue.

- Advertising Budgets: Companies may cut their advertising budgets during economic downturns, reducing WBD’s advertising revenue.

- Interest Rates: Rising interest rates can increase WBD’s borrowing costs, affecting its profitability.

9. How to Stay Updated on Turner Network Television Stock News

Staying updated on Turner Network Television stock news is crucial for investors. Here are some ways to stay informed:

9.1 What are Reliable Sources for WBD Stock News?

Reliable sources for WBD stock news include:

- Financial News Websites: Websites like Bloomberg, Reuters, and The Wall Street Journal provide comprehensive coverage of financial markets and company news.

- Company Investor Relations: WBD’s investor relations website provides press releases, financial reports, and investor presentations.

- Market Analysis Reports: Reports from investment banks and research firms offer in-depth analysis of WBD’s financial performance and prospects.

9.2 How Can I Use News to Inform My Investment Decisions?

You can use news to inform your investment decisions by:

- Monitoring Financial Performance: Tracking WBD’s revenue, profitability, and cash flow.

- Analyzing Strategic Decisions: Evaluating WBD’s strategic decisions, such as acquisitions, partnerships, and content investments.

- Assessing Market Trends: Understanding how market trends, such as cord-cutting and streaming growth, affect WBD.

10. Frequently Asked Questions (FAQs) About Turner Network Television Stock

10.1 Is Turner Network Television (TNT) a good investment?

Investing in Warner Bros. Discovery (WBD), the parent company of TNT, depends on various factors, including financial performance, market trends, and strategic decisions. Evaluate these factors before investing.

10.2 How does TNT contribute to Warner Bros. Discovery’s revenue?

TNT contributes to Warner Bros. Discovery’s revenue through advertising, subscriber fees, and content licensing.

10.3 What impact does cord-cutting have on TNT and WBD stock?

Cord-cutting can negatively impact TNT’s viewership and revenue, potentially affecting WBD stock.

10.4 What strategies is TNT using to adapt to cord-cutting?

TNT adapts to cord-cutting by offering content through streaming services, investing in original programming, and expanding digital distribution channels.

10.5 What are the main competitors of TNT in the media industry?

Competitors of TNT include other cable networks, streaming services, and content providers.

10.6 How can I buy Warner Bros. Discovery (WBD) stock?

You can buy Warner Bros. Discovery (WBD) stock through a brokerage account or online trading platform.

10.7 What are the risks associated with investing in WBD stock?

Risks associated with investing in WBD stock include high debt load, integration challenges, market competition, and cord-cutting trends.

10.8 What are the advantages of investing in WBD stock?

Advantages of investing in WBD stock include a diversified portfolio, strong content library, global reach, and cost synergies.

10.9 How can I stay updated on WBD stock news and financial performance?

Stay updated on WBD stock news and financial performance through financial news websites, the company’s investor relations website, and market analysis reports.

10.10 What financial metrics should I consider when evaluating WBD stock?

Consider revenue, net income, earnings per share (EPS), debt-to-equity ratio, and cash flow when evaluating WBD stock.

In conclusion, Turner Network Television stock, represented by its parent company Warner Bros. Discovery (WBD), presents both opportunities and challenges for investors. Staying informed about the company’s financial performance, strategic decisions, and the evolving media landscape is essential for making informed investment decisions.

Ready to dive deeper into the world of television and media? Visit monstertelevision.com today for the latest reviews, news, and community discussions about your favorite monster-themed TV shows! Explore our in-depth analyses, catch up on breaking news, and join a community of passionate fans just like you. Don’t miss out – your next favorite show is waiting to be discovered. Head over to monstertelevision.com now and start exploring!

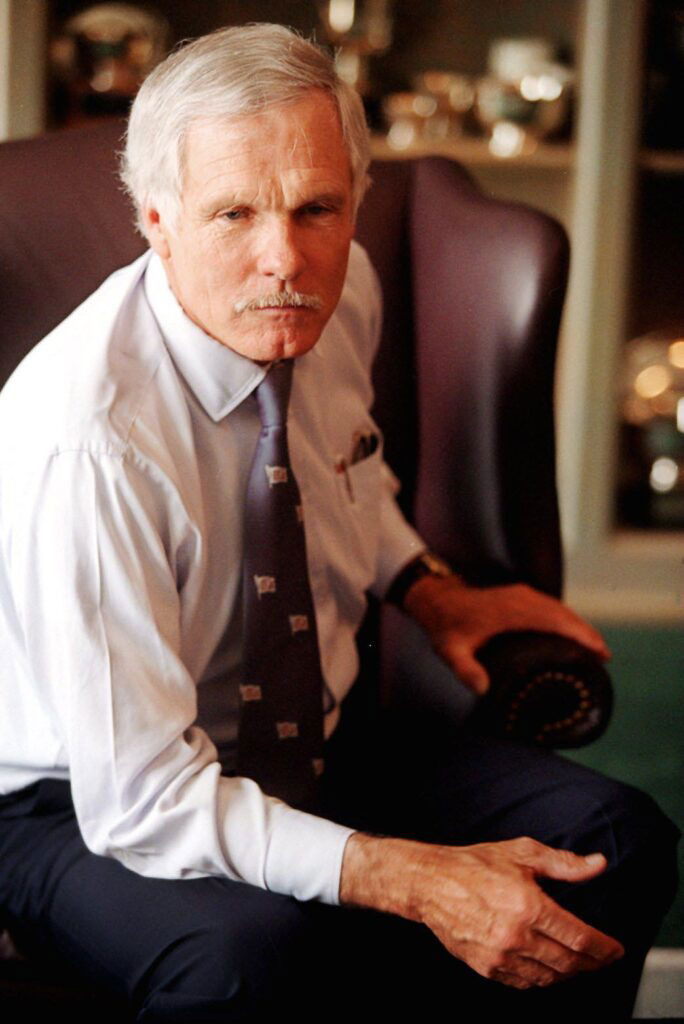

Ted Turner’s vision created a lasting impact on the media landscape.

Ted Turner’s relentless pursuit of innovation revolutionized cable television.

Ted Turner celebrating at the World Series after the Atlanta Braves victory.

Ted’s Montana Grill showcases Turner’s entrepreneurial spirit beyond media.